Despite early warnings from grid operators and power grid reliability experts, the unprecedented heat waves this past summer did not cause widespread rolling blackouts or brownouts across the nation. A spring report from the North American Electric Reliability Corp. (NERC) and the Federal Energy Regulatory Commission (FERC) had warned utilities and consumers that Southwest Power Pool (SPP), the regional grid operator manages the transmission grid in 14 states including Kansas, was at an elevated risk for summer reliability issues due to high temperatures and other conditions.

High temperatures increased electric demand when electric consumers used air conditioners to stay cool. Other conditions included widespread droughts, which increased electricity demand for irrigation, and naturally diminished wind energy output during hot days.

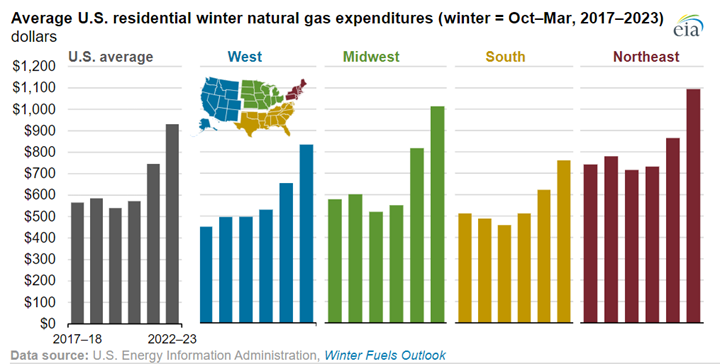

High Natural Gas Prices Expected Through Upcoming Winter

While the U.S. power grid defied warnings of major electric service interruptions last summer, consumers still experienced a higher cost of energy due to an increase in the price of natural gas, a key driver for the cost of energy purchased from the SPP’s Integrated Marketplace (IM). Sunflower Electric Power Corporation, Western Cooperative Electric wholesale power supplier, sells and purchases its wholesale electricity through the SPP IM, the regional wholesale energy market that dispatches generating units across the 14-state SPP region based on reliability and lowest cost. Near the beginning of each month, electric utilities calculate their Energy Cost Adjustment (ECA) for the electric load served in the previous month. The ECA, a monthly pass-through cost or credit included in consumers’ electric bills, is used to recover variable energy costs including fuel, market energy settlements, and other energy-related variable operating costs.

The monthly average Henry Hub natural gas spot price, which is a U.S. benchmark, more than doubled from

$2.39 per million British thermal units (MMBtu) in Oct. 2020 to $5.66/MMBtu in Oct. 2022. The 12-month high of $8.81 in August 2022 was the highest price since 2008. Prices have generally increased since mid-2021 because demand growth has outpaced domestic production supply, keeping inventory levels low. Part of the reason domestic supply is down because of increasing exports of liquified natural gas (LNG) to consumers in Europe who have been impacted by reduced supply of Russian natural gas due to the conflict in Ukraine.

Unfortunately, the U.S. Department of Energy predicts high costs of natural gas this winter as well. In November, the U.S. Energy Information Administration reported that U.S. natural gas prices are expected to average approximately $6.09/MMBtu this winter, the highest winter real price since 2009-10. The estimated price of $6.09 compares to a $4.56/MMBtu average last winter, due to seasonal demand for natural gas in space heating and a higher demand for LNG exports (eia.gov). This is a 33.5% increase.

The good news is that Sunflower’s fleet of electric generation units will continue to provide an offset to market energy price increases. It did so during the historic 2021 Storm Uri, and it did so during the sweltering heat of the summer. During the months of July to August, the hottest time of the year in our service territory, about 43% of the increase in market prices from 2021 to 2022 was offset by the hedge provided by Sunflower’s generation resource mix. Over this period, market prices increased $0.04181/kWh compared to last year, but the ECA only increased $0.02387/MWh.

“As fellow electric cooperative members and consumers of electricity, we at Sunflower understand the pain in receiving high electric bills, especially at a time when the cost of everything else is going up,” said Stuart Lowry, president and CEO of Sunflower. “Be assured that Sunflower will continue to pursue measures to help mitigate the high market cost of energy.”